Teaching kids about money: Practical, effective, and real-life tips from parents and finance pros

When entrepreneur Michelle Hon started giving her 7-year-old a daily allowance, she was surprised to see how quickly it turned into daily trips to the school bookshop, with each visit resulting in a new piece of stationery.

Instead of spending on canteen food, her daughter had found a different priority - forgoing eating in favour of buying small trinkets she liked.

To Michelle, this presented a perfect opportunity to teach her daughter about spending responsibly.

"I explained that her pocket money is for food, and if she has any balance at the end of the week, she could use it to shop for something she wants - instead of buying something new every day," she shared.

But this raises the question: if this is how a 7-year-old navigates spending, are they really ready to handle their own bank account and debit card?

Last week, OCBC launched MyOwn Account - a first-of-its-kind in Singapore - which enables children aged seven to 15 to be the sole owner and operator of their own bank accounts (albeit with certain parental controls).

"From contactless payments to online transactions, the way our children perceive and handle money is very different from older generations. It can be easy for them to forget that digital payments are tied to real money and savings. Hence, it is crucial to help our children understand that every tap or click has a real financial impact," said Minister of State for Home Affairs, and Social and Family Development, Sun Xueling. She was speaking at the launch event for OCBC's MyOwn Account, held at OCBC Wisma Atria last Sunday (Oct 20).

While some parents might feel like seven is too young, parents and finance experts that AsiaOne spoke to pointed out that earlier exposure to money management has its benefits.

"Parents shouldn't wait too long, as some skills and habits should be set while they are young and in their formative years," noted Steven Peeris, a market analyst, writer, and host of AsiaOne's finance YouTube series, Moneywise.

"Building a solid foundation for money management will stand them in good stead for when they start earning their own money as young adults."

Whether you're a parent of a primary school child or a teenager, here's what you need to know about the functions of OCBC MyOwn Account - and what it can teach your child about financial literacy.

Parental oversight remains essential

Only parents can open an OCBC MyOwn Account, and while it grants children access to their money, key safeguards remain in place. These include daily transaction limits, real-time alerts, and a "kill switch" to suspend the account in case of suspicious activity.

Plus, there's the OCBC Money Lock feature, which provides an extra layer of protection against scams by allowing funds to be released only after identity verification. Sun noted during the launch event that this function is useful for both children and adults alike.

"This is a very safe function for us to prevent monies from being digitally transferred without our knowledge," she said.

Parents can also set a daily, weekly, or monthly allowance that gets credited straight into this account.

As a mother of three, Michelle acknowledged concerns around potential risks, such as children being more vulnerable to scams or even blackmail.

"But there's a transaction limit that parents can set, and there are features such as withdrawal notifications to parents, so I think that would put our minds at ease," she said.

Steven also pointed out that the digital tools available could offer parents even greater insight into their children's spending.

"Cash is much harder to track. With a purpose-built dashboard to monitor activity, it would be far easier for parents to monitor their child's online banking and digital payments," he stated.

Let children make mistakes

After Michelle had a talk with her then 7-year-old, there "hasn't been a problem since" with how she spends her pocket money.

Michelle's takeaway and advice for other parents is this: start small and allow children to make mistakes, as it is part of the learning process.

"We started with $10 a week. If they made a mistake, it's only $10 and they'll learn from it," she shared.

Finance content creators Sara and Aaron Wee, also known as The Weeblings on TikTok, agreed with this approach. Though not parents themselves, the siblings emphasised the importance of learning through trial and error.

To reduce the risk of monetary loss, they suggested introducing children to financial responsibility gradually. This could mean opening a savings account but holding off on giving them access to a debit card or banking app until they're ready. Alternatively, parents can choose to manage the account balance on their end.

"For example, you can limit the balance to less than $100 at any time, so that your child is allowed the freedom to learn and make mistakes without it being detrimental," they explained.

Empowering children in age-appropriate ways

For the Weeblings, one of their earliest lessons in money management came when their mother opened bank accounts for them as children to instill the habit of saving.

"I was taught to save from a young age, so that was something I've been doing almost my whole life and brought with me into adulthood," Sara shared.

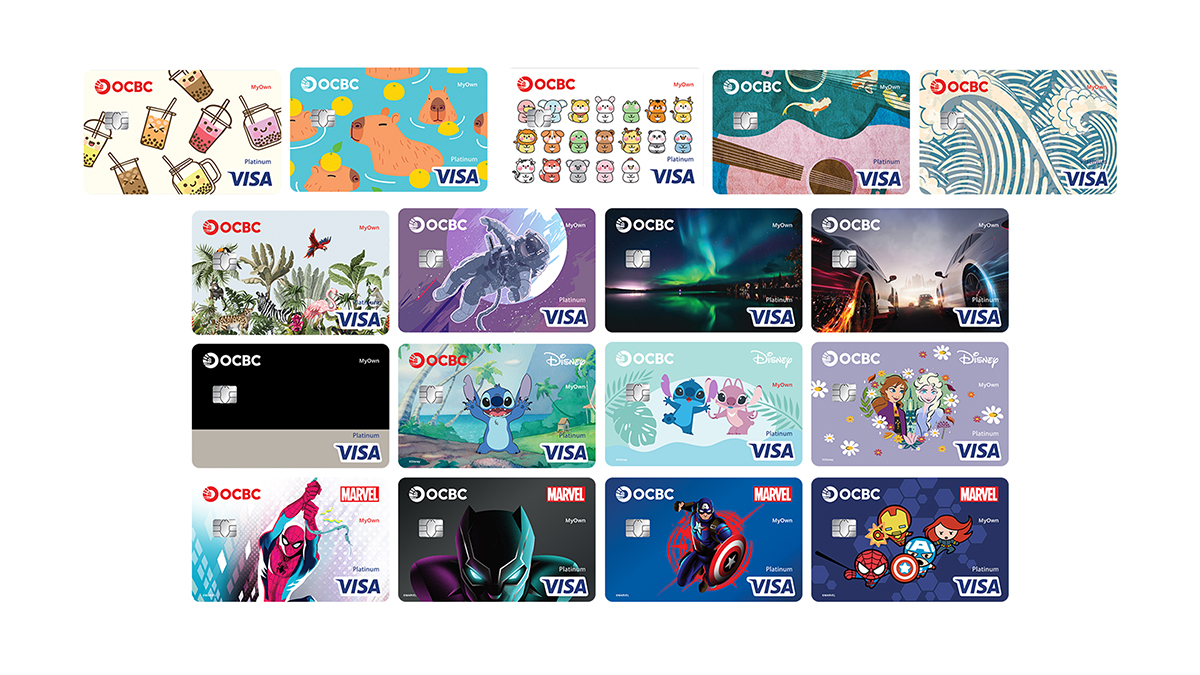

For children aged seven to 12 years old, the OCBC MyOwn Account can be operated independently without the need for a smartphone. The account comes with a debit card, with over 15 fun designs (including popular Disney and Marvel characters) to choose from. They can make payments with the card, as well as check their account balance and make withdrawals at OCBC ATMs.

Children can also make deposits at OCBC's cash deposit machines by themselves, which could encourage them to develop healthy saving habits.

For older children aged 13 to 15 years old who own smartphones, the OCBC MyOwn Account introduces them to digital banking. Through the OCBC app, they can manage their accounts, check balances, pay with PayNow and discover exclusive offers for OCBC MyOwn debit card users.

The app also offers educational content on financial and digital literacy through comic strips and activities featuring Disney characters.

Beyond saving, Michelle - who is also a content creator - offers her three children opportunities to earn money whenever they appear in paid engagements with her.

And when they are around 9 to 10 years old, she allows them to decide how to allocate their earnings - how much to keep for spending, save in their bank accounts, and invest with their father, who places the money in an investment account.

"We explained to them that you can save for anything you want in the near future, and it'll give you a little bit of interest in return. As for investing, you can't touch the money for a long time, but it will grow and become more when you're older," she said, adding that her children are often eager to set aside a portion of their money for investing.

"But of course, we also want them to enjoy their money. We don't tell them that they must save and invest everything."

Steven finds gamification to be another effective teaching method for children of all ages. He suggested offering rewards for positive behaviours and even introducing penalties for certain actions, which could result in deductions from their reward tally.

"This makes children value the money they've earned and forces them to think carefully about their spending habits, which will be very beneficial as they grow up," he explained.

He also advised that parents gradually increase their children's responsibility, so by the time they reach secondary school, they can manage a full month's allowance.

"Such an arrangement will be beneficial to help them build good money management habits as it is akin to receiving a monthly salary," he added.

How to tell if your children are ready?

So, how can you determine if your children are ready to handle the responsibility of their own bank account and debit card?

According to Steven, the key is to observe their attitude, behaviour and level of effort.

"Actively calculating how much they need to save for a rewards target, or how much they need to study to get a target grade, are all signs of effort and a good attitude," he said.

He added that when children begin to manage their money more thoughtfully, by avoiding impulsive spending, saving consistently and tracking their expenses, it's a good indicator that they are ready for more financial responsibility.

Michelle joked that a basic requirement might be the child's ability to do math, but ultimately believes that action speaks louder than words.

"The sooner we let them take charge of something, the earlier we can tell if they can do it themselves," she concluded.

And for all you know, your children might just surprise you - in the best way.

To find out more about the OCBC MyOwn Account for your child, click here.

This article is brought to you in partnership with OCBC.